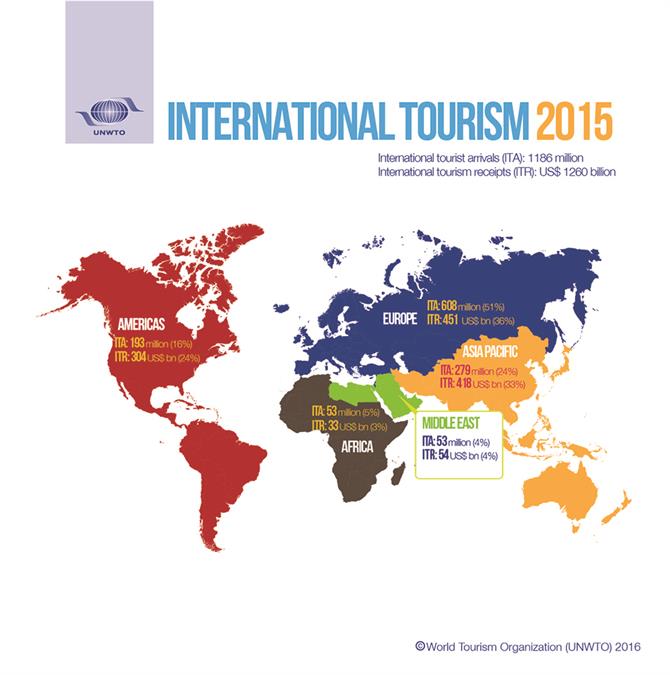

International tourist arrivals worldwide grew by 4% between January and June 2016 compared to the same period last year. Destinations worldwide received 561 million international tourists (overnight visitors), 21 million more than in 2015, according to the latest UNWTO World Tourism Barometer.

International tourist arrivals to Europe grew by 3% between January and June 2016, with mixed results across destinations. Northern Europe and Central and Eastern Europe both recorded 5% more international arrivals. Though many destinations posted positive results, growth in both Western Europe (+1%) and Southern Mediterranean Europe (+2%) was slow.

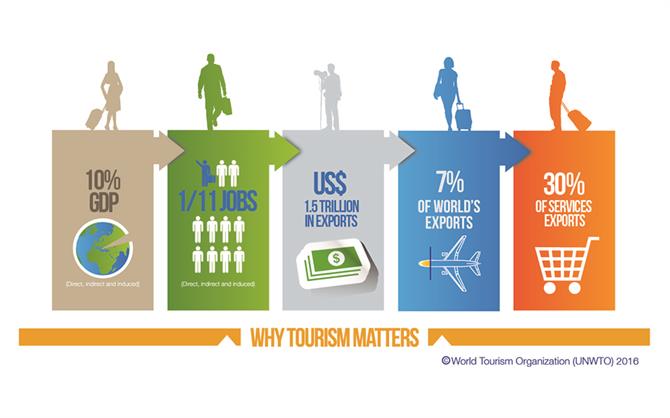

“Tourism has proven to be one of the most resilient economic sectors worldwide. It is creating jobs for millions, at a time when providing perspectives for a better future to people of all regions is one of our biggest challenges. But tourism is also creating bonds among people of all nations and backgrounds, bringing down stereotypes and fighting fear and distrust”, said UNWTO Secretary-General, Taleb Rifai.

“Safety and security are key pillars of tourism development and we need to strengthen our common action to build a safe, secure and seamless travel framework. This is no time to build walls or point fingers; it is time to build an alliance based on a shared vision and a joint responsibility.” he added.

Demand for travel abroad varies across source markets

China, the world’s top source market, continued to report double-digit growth in expenditure on international travel (+20% in the first quarter of 2016), benefiting destinations in the region and beyond. The United States, the world’s second largest market, increased expenditure on outbound travel by 8% through July, thanks to a strong currency. Third largest market, Germany, reported a 4% increase in expenditure through July.

Other markets that showed robust demand for outbound travel in the first half of 2016 were Spain (+20%), Norway (+11%), Australia (+10%) and Japan (+6%). Meanwhile expenditure from the Russian Federation and Brazil continues to be weak, reflecting the economic constraints and depreciated currencies in both markets.