There has been a lot of talk about the possible negative impacts that short-term holiday rentals have on long-term rentals in Spain: Televised debates, newspaper articles and myriad of declarations of intent from several political figures from some autonomic and local governments.

But how much does the short-term holiday rental industry really affect the long-term rental market?

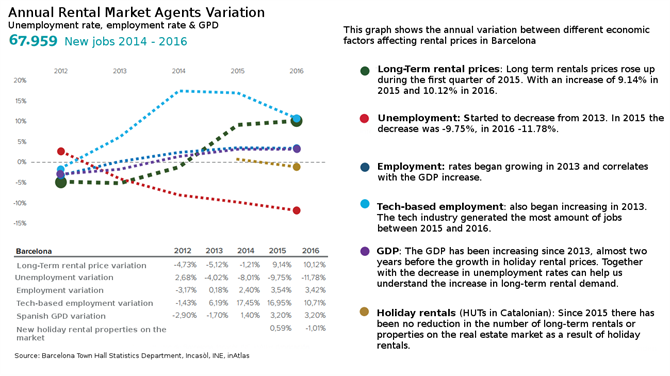

Barcelona, in particular, has experienced some controversy regarding this issue and the measures taken to regulate tourism overpopulation. In a recent study from past June carried out by the Catalonian Holiday Rentals Association (Apartur in Spanish) and the Spanish Federal Association of Holiday Rentals (Fevitur in Spanish) through the statistic company inAtlas, states that Barcelona has been experiencing a rise in the average price per square meter for rent since 2015. Around 9.14% during 2015 and 10.12% in 2016.

Some of the attributions that have been received by holiday rentals or habitatges d'ús turístic, HUTs (Catalonian denomination for holiday rentals) have been to limit access to housing by the local population, as well as to contribute to the decrease of the housing supply of long term rental due to employment for holiday purposes.

What’s making prices rise?

Between 2014 and 2016 the number of residents in Barcelona increased by 15,371 (13,000 Spanish residents and 2371 foreign residents). The population growth was mostly concentrated in the neighbourhoods with the highest income per capita. The Spanish population in this areas experiences an accumulated growth of 18%.

Taking into account the data provided by the report, the increase in rental prices in Barcelona is due to the following fundamental factors:

The increase in the number of residents with higher level education

The decline of unemployment in the city

The rise in income within certain sectors

The number of residents with higher level education has increased between 2014 and 2016. Barcelona has gone from having a 23.93% share of its working population with university studies, in 2011 to 29.38% in the year 2016.

The economic growth of the city has, in turn, provoked a directly proportional increase in the price of the rents. The City of Barcelona has reduced its unemployment rate during the past three years, reaching a decrease of more than 20,000 people.

Employment in the city grew +2.40% in 2014, +3.54% in 2015 and +3.42% in 2016. The accumulated figure of created jobs, between 2014 and 2016, is 67,959. Undoubtedly, both indicators reflect three years of GDP growth (2014: 1.4%, 2015: 3.2%, 2016: 3.2%).

This data also shows an increase in income levels for the profiles mentioned above. Among all sectors, the tech-industry stands out, contributing 12.48% of total employment between 2014 and 2016.

The technological industry enjoys one of the highest average wage levels in Barcelona. The average salary in the city in 2015 was €28,861 while the tech industry had an average €34,956 in the same period.

Barcelona holiday rental radiography

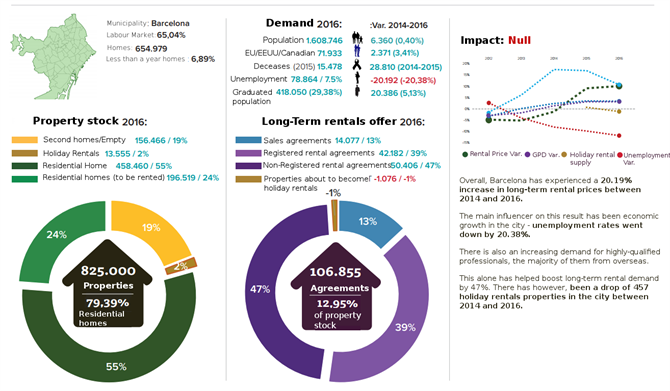

Despite an increasing perception of a shortage of rental properties, Barcelona has increased its market during the last five years, from 105,152 homes in 2015 to 106,855 in 2016.

On the other hand, the supply of holiday rentals in the city has suffered a decrease in 2016 compared to the previous year. Reaching a total of 1,076 homes, which returned to the long-term rental market.

As the study points out, the volume of holiday rentals in Barcelona represents 1.64% of the total stock of available housing, a total of 13,555 units.

The idea that holiday rentals are the sole cause of the increase in rental prices, fewer properties available for long term rent, or has caused the movement of the population to other areas is not supported.

Neighborhoods such as Ciutat Vella have not experienced a reduction in the number of households due to the presence of tourist accommodation. The biggest impact on the neighbourhood results from a change in tenant profile.

The new profile of people demanding a rental in Ciutat Vella has had a bigger impact on real estate and rental prices than the number of holiday rentals in the area.

The increase in housing rental prices is homogenous throughout the city, even in areas where there are no holiday rentals on offer. According to the report, the factors that affect the demand for long-term rentals are the same in different neighbourhoods.

To sum up

According to the report, it’s not fair to justify the increase in the long-term rental prices based solely on the growth of holiday rentals in the city. Since 2015 there has been no reduction in the number of long-term rentals or properties on the real estate market as a result of holiday rentals.

A fact that clearly shows that the holiday rental industry is not mining the long-term market and, therefore, not being to blame for an increase in rental prices.

A strong case can be made that long term rental prices in Barcelona have increased in specific neighbourhoods due to the change in the profile of tenants with higher purchasing power than in previous years (gentrification).

In addition, the percentage of holiday rentals represents just 1.64% of the Barcelona housing stock. An unrepresentative percentage that brings to question the argument of the high level of properties being used for tourist accommodation in the Catalan capital.

During 2016 the residential housing market returned units to the residential market, which translates into an increase in supply. The profitability of holiday homes also does not play a role in the offer of one type of housing or another. This is just an incentive that allows the owner to opt for one option or another.